Payroll company or self-employed contractor?

Congratulations! You have decided to work as a self-employed contractor. But should you operate independently or through a payroll service?

A payroll company provides excellent support for contractors who are stepping into contracting assignments. Cool Company for example takes care of taxes, insurance, employment protection, and holiday pay so you can focus on your assignments. We will give you the safety of being an employee while giving you the flexibility of being a contractor and choosing your own assignments!

Self-employed vs contractor: What is the difference?

Making the decision between being self-employed vs contractor through a payroll company is one of the first challenges you’ll face when starting out. But what is the difference between being self-employed and an umbrella company?

Self-employment is the dream of many. Being in full control of your own professional success sounds appealing and deservedly so. But self-employment does come with a certain set of drawbacks:

• You are solely responsible for your business. This will most likely include the risk that your personal and business assets are not separate from each other.

• You are not eligible for employment protection and benefits.

• You must possess in-depth knowledge of accountancy (or hire an accountant).

A payroll company will let you avoid the hassle and risks, while leaving you the power over the clients you work for. Let’s look at some of the reasons you would want to use Cool Company while on assignment.

4 reasons to join a payroll company as a contractor

1 Choose Freedom

Are IR35 assessments, invoicing, tax returns, and accounting software giving you a headache? We know that most contractors choose umbrella employment for its freedom…not the hassles of administration.

With Cool Company you get to keep the freedom of setting your own schedule and choosing your own clients. You complete your work as usual; we take on the complicated bits!

2 Get paid quick and easy

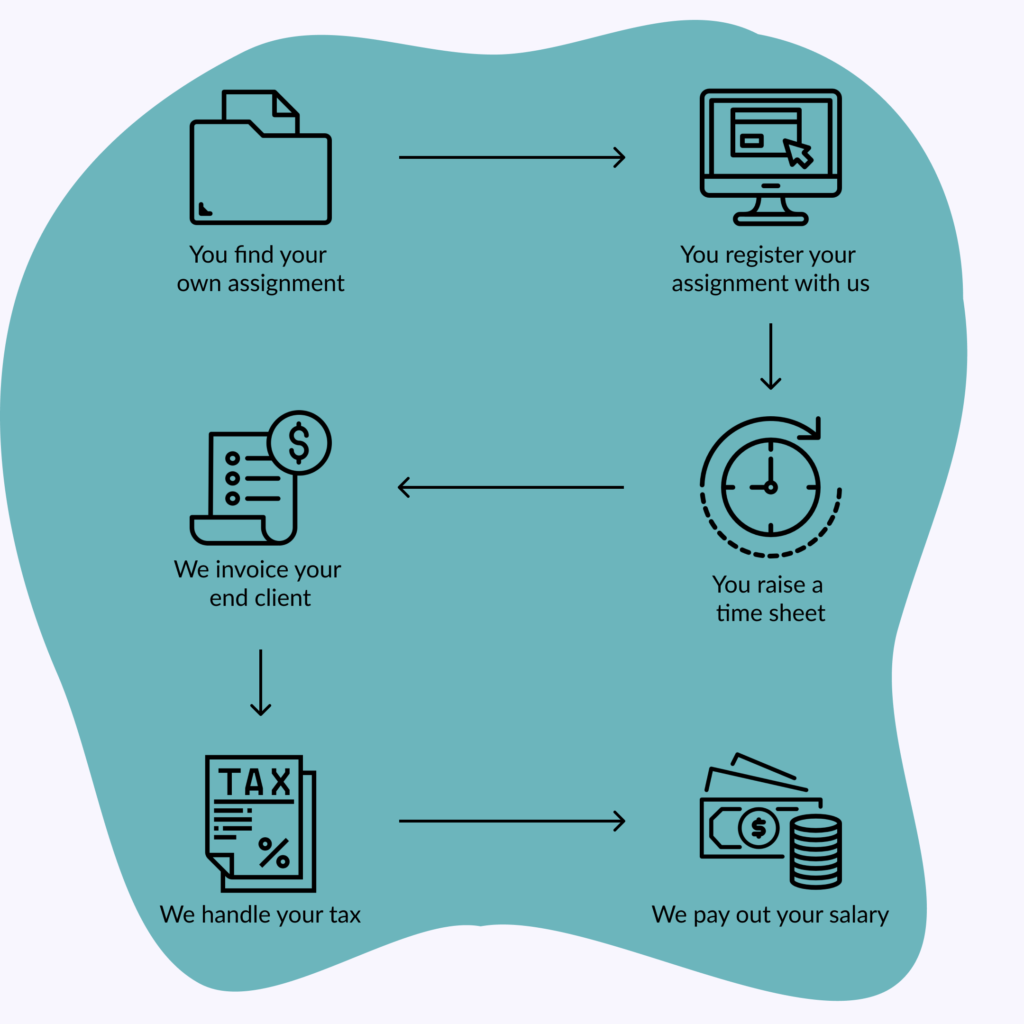

Our intuitive, easy-to-use platform takes care of the whole invoicing process. Submit a timesheet, when your client pays the invoice, we make all required deductions and pay you the net amount via Faster Payment® – it’s a simple process for you, every time.

Read more about what PAYE is and use our PAYE Calculator.

3 Feel safe and secure

As a contractor you will often work with clients that require you to be covered for professional indemnity and public liability. To lower your own operational risk, you will also need to consider insurances against unforeseen events like illness or accidents.

Cool Company is your built-in safety net. By joining us, you will be automatically covered with all mandatory insurances such as employer liability, professional indemnity, and public liability insurance.

Learn more about mandatory insurance requirements for UK contractors in our article.

4 Focus on what is important

Cool Company has you covered in every way. For you as a contractor our payroll solution handles all administration and deductions, invoicing, and insurance. All so that you can fully focus on growing your business.

Psst.. Are you a contractor that is finding it hard to achieve a work-life balance or struggles with the conflicts that can arise when working online? Read our tips about work-life integration and on dealing with virtual workplace conflict

For an even more in-depth comparison between self-employment and a payroll company, read our article “Umbrella vs Limited vs Self-Employed” in which we run through the pros and cons of each solution.

FAQ

What is a self-employed contractor?

A self-employed contractor is a person who performs contract-based work for a client. As a self-employed individual they are not eligible for employment benefits and are required to take care of their own taxation, insurance, and retirement plans. In contrast, a payroll company gives contractors all the safety and support they would get from a regular employer.

Why do contractors use payroll services?

There are many advantages to using payroll services as a contractor. A company such as Cool Company takes care of all taxation and payroll matters, so you can avoid the stress that comes with having to track all the administration of working as a self-employed individual. On top of that, you can benefit from the safety of employment (insurance, holiday pay, etc.) while remaining independent in your day-to-day work.

Get started

Get started with our quick and easy 5-step process. It’s an all-in-one solution that’s trusted by over 70,000 contractors and agencies. Cool Company gives you the freedom to focus on your assignments and win back valuable time for what matters most.