Compliance

Contractor compliance is an important part of contractor management. Cool Company makes sure that the contractor complies with all the legal requirements, whether it’s tax compliance, National Insurance or employment protection.

Contractor compliance

Cool Company is one of the UK’s most trusted umbrella companies providing contractor compliance management services to their clients. This gives a full assurance that contractors are complying with all legal requirements set by the HM Revenue and Customs (HMRC).

Contractor compliance can be a complex subject for many new contractors. Here are some key pieces of information you should know.

Umbrella Company – Ideal solution for compliance management

In the UK, contractors can work through either an umbrella company or a limited company.

An umbrella company is an intermediary business that provides a service to contractors to manage their tax and national insurance obligations. Contractors operate as employees under umbrella companies and are provided with access to all their rights under the Employment Rights Act 1996.

Many contractors prefer to use an umbrella company rather than other options because it allows greater flexibility without the responsibility of running a limited company. The umbrella company will ensure that contractor compliance is aligned with HRMC tax rules.

Umbrella companies offer contractors the security of being an employee and the freedom to choose their own clients and work. It is an ideal compliance management solution that meets all the legal requirements set by HMRC, offering security and freedom to contractors so they can focus on their clients and grow their business.

When you work through an umbrella company as a contractor, you are paid through the PAYE scheme. This means that all taxes and National Insurance deductions are deducted from each payment.

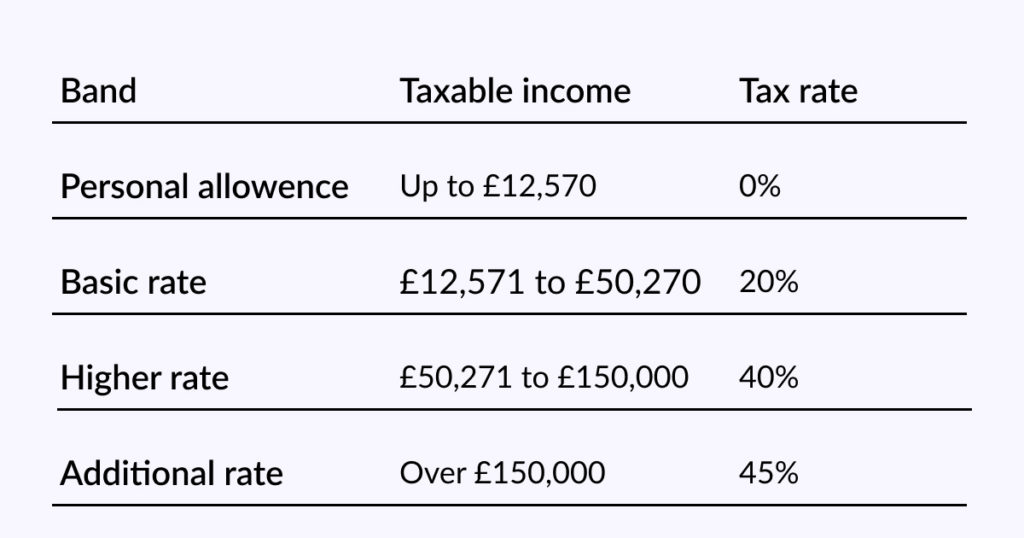

PAYE Income Tax Rates

The following table from Gov.uk shows the tax rates paid in each band for 2022/2023 if you have a standard Personal Allowance of £12,570.

Limited Company

A Limited Liability Company (also known as a Personal Service Company or Ltd. Co.) is a registered business in the UK. It requires registration of the business name and, depending on the amount of revenue, registration for VAT.

There are many responsibilities and administrative obligations involved in running a limited company. Click here to find out more about the advantages of an umbrella company over a limited company.

Self-Employment

Self-employment refers to an employment status in the UK whereby an individual is registered with HMRC and completes taxes annually through a self-employment tax return.

Self-employment can create some difficulties for contractors. Click here for more information on self-employment.

Self-employed IR35 compliance

IR35 refers to UK tax legislation that was designed to prevent tax avoidance from individuals who received payments from clients through an intermediary, such as a limited company. The legislation was created because individuals were using these intermediaries to avoid higher taxes.

Self-employed IR35 compliance rules concerning the status of a contractor can be complex. To find out whether you are inside or outside IR35, click here to read our IR35 guide here.

Employer National Insurance

Employers’ National Insurance is a government program that requires all employers to pay contributions for employee benefits and state pensions. The Gov.uk website outlines the classes and payments based on employees’ earnings. For contractors earning more than £242 a week and who are under State Pension age, have their deductions automatically deducted by their employer.

Permanent employees do not usually see this payment on their payslips, but contractors working through umbrella companies will see this deduction.

Any questions? View our helpful FAQ section for more details.