What is PAYE tax?

PAYE stands for “pay as you earn”. It refers to the income tax which is deducted from your salary before you receive it.

PAYE is the most common tax system used to tax employees. Your employer takes the amount due from your salary and pays directly to HMRC (Her Majesty’s Revenue and Customs). This means the money is deducted automatically and the remaining (NET) amount is paid into your bank account. National Insurance and student loan repayments are deducted in a similar way to your PAYE tax. PAYE ensures that you have the right amount of tax deductions taken according to HMRC’s records.

Being self-employed makes paying taxes more difficult, as you will be responsible for submitting tax returns directly to HMRC. Along with keeping accurate financial records throughout the tax year. Learn more about self-employment and PAYE as you read on.

How is PAYE tax calculated?

PAYE tax is mandatory for all employed individuals and is calculated based on each payment made to you. Most employees have a tax-free allowance for each year. In 2021-22 the personal allowance is £12,570 (it was £12,500 in 2020-21).

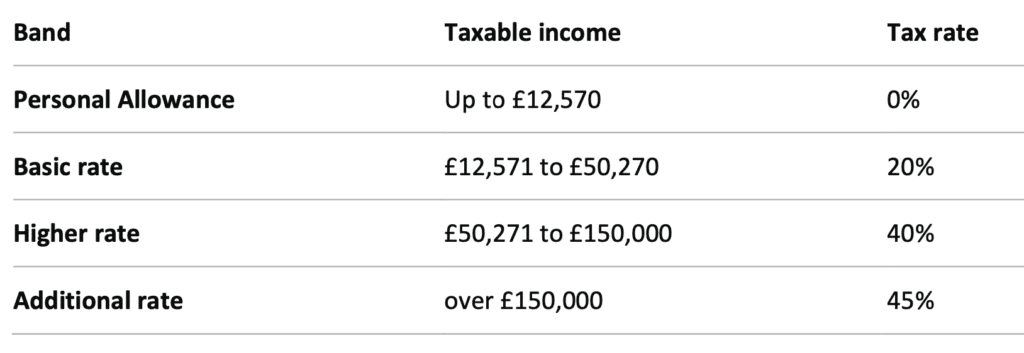

If you earn more than the personal allowance, you will be taxed on a banded system based on your expected earnings, the bands are 20%, 40% or 45% of your earnings. The table below displays the tax banding rates:

Your PAYE deductions will be evenly distributed over the tax year. This way you generally pay an equal amount each month. This also means that if you are paying too much PAYE, HMRC may refund you in your payments or at the end of the tax year. If you pay too little PAYE tax, HMRC may adjust your tax code to recover underpayments.

Not sure about how much PAYE you will pay this year? With our free PAYE calculator you can easily estimate your PAYE tax. Just enter your annual gross salary and find out how much money you might take home.

PAYE and self-employed

If you are employed, your employer will take care of paying PAYE by deducting it from your gross salary. You do not need to do anything.

But what if you are working as a freelancer or contractor? Being self-employed means that you are fully responsible for paying the right amount of taxes based on your annual income. You will have to complete a self-assessment tax return once a year and pay your owed taxes directly to HMRC. This is also the case if you run your own limited company.

If this sounds too complicated or you are afraid of missing a deadline (!), Umbrella PAYE might be the right alternative for you. For a small, fixed margin an Umbrella company will manage all taxes and administration for you. Read more about the pros and cons of Umbrella PAYE in our blog.

FAQ about PAYE

PAYE stands for “pay as your earn” and is the system used by the HMRC to tax employees.

The amount of PAYE you must pay is based on your annual gross salary and your tax code. Read above how your PAYE is calculated or use our free PAYE calculator.

The amount of PAYE you must pay is based on your annual g

Your PAYE tax depends on your income. The tax office will apply a certain tax rate according to your taxable income:

You pay 0 % on annual earnings up to £12,570

You pay 20 % on annual earnings between £12,571 and £50,270

You pay 40 % on annual earnings between £50,271 and £150,000

You pay 45 % on annual earnings over £150,000

Your employer will deduct your PAYE tax from your salary based on your tax code.

If you are operating as a freelancer or contractor, the responsibility for paying tax lies completely with you. You will have to complete a self-assessment tax return. Read above how Umbrella PAYE will manage taxation for you.

Overpaying PAYE means that you have paid more tax than you were required to. You will be sent a P800 from HMRC showing if you are due a tax refund. You will normally get your form by November. HMRC will automatically refund you by sending a cheque within 14 days after you have received your P800. If you think you have overpaid PAYE, but HMRC does not refund you, contact them or file a claim via the Government’s website.

If you pay too little PAYE, HMRC will automatically adjust your tax code for the next year. Usually, you will have a reduced personal allowance and thus pay PAYE on a bigger portion of your income. If you owe more than £3,000, HMRC can request a direct payment from you.

Get started

Get started with our quick and easy 5-step process. After verification, all you have to do is submit a timesheet and wait for your client to pay us. It’s an all-in-one solution that’s trusted by over 70,000 contractors and agencies. Cool Company gives you the freedom to focus on your assignments and win back valuable time for what matters most.