Join Cool Company today and seize an amazing opportunity that lasts all year. We’re cutting our margin by more than 50% for both weekly and monthly timesheet

How do payroll services work?

Cool Company will manage your payroll and all client invoicing. With three simple steps you can get paid by your client compliantly and hassle-free:

Secure your own assignments.

As an employee of a payroll company, you keep the freedom of choosing your clients. Just register your assignment in our portal.

Submit your timesheet.

Record and submit the time you have worked. We will convert this into an invoice to your client.

Get paid. We handle everything else.

As soon as your client pays the invoice, we deduct all taxes, national insurance, and pension. Then we pay you the rest as your net income.

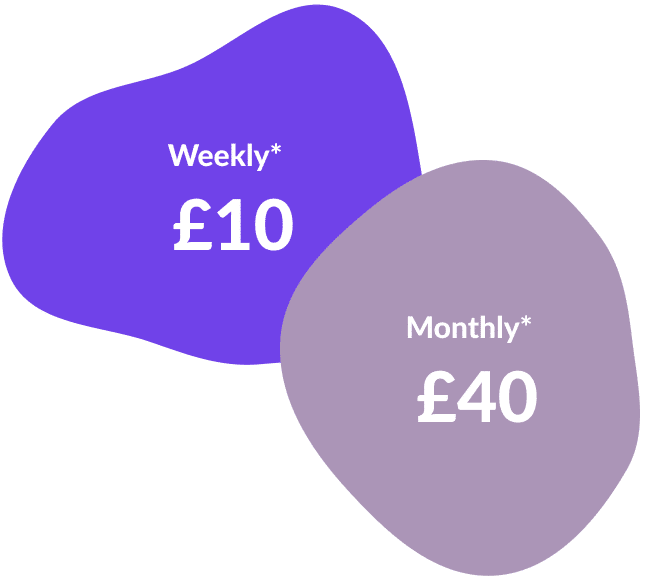

*) E.g. you raise a timesheet that stretch over one week or one month.

You only pay the margin when your sent invoice is paid.

Spring discount!

We’re kicking off spring with an incredible spring campaign where we offer all new contractors a heavily discounted margin for the entire year. The discount of over 50% applies regardless of whether you choose a weekly or monthly timesheet.

You’ll get access to the discount when you create an account and get started, with our customer support available every step of the way if you have any questions. You can also request a call back for any questions or concerns.

Pricing explained

At Cool Company our pricing is designed to match how often your agency will pay you. A weekly Timesheet will have a retain margin of £10 and a Monthly timesheet £40, this is to cover our operational costs.

For our small margin, we make sure all PAYE taxes are deducted, insurance cover is provided and you have access to all employment rights as you would expect.

Questions about price

Choosing the correct pay schedule is important not only for Cool Company but for yourself. Each time you are paid we report this to HMRC, if you pick the wrong pay schedule it could cause your tax-free allowance to be incorecctly calculated and this can affect your net take-home pay. If you are unsure customer service is always on hand to discuss and help you.

Our margins are retained per invoice so, until your invoice is paid we do not retain any margin. This allows you the freedom to use our service only when you need to without any additional cost.

Yes, you can change your payment schedule based on how often your client will be paying you. Please be aware that moving between pay schedules can only be actioned at the end of the tax week or the month of your current pay schedule. For example… Tax weeks end each Tuesday and tax months end on the 5th of the following month.

If you are unsure please get in touch.

According to our users

We are proud of 100,000+ successful freelancers, contractors and agencies that have given us their trust.

Anita, 14 February 2024

The best umbrella company experienced to date

Cutting a long story, experience, short; I moved umbrella companies to Cool Company, the best decision made.

Communication/s, prompt payment of wages namely same week payments and reliability have all been my experience. I have known Cool Company for over a year now and I have had no issues at all. Cool company are professional but personable too.

Annie, 30 May 2023

Using Cool Company made it possible to do internship with a company outside Sweden.

The procedure is clearly mentioned in the website and the customer service line was really helpful, they answered all my queries with clarity. I really liked using Cool Company and would recommend it for freelancers.

Karen, 27 February 2024

The best umbrella company ever used

I have tried to avoid using an umberella company in the past (after having a few bad experiences), but Cool Company have surprised me. All of the staff there are super helpful and efficient and have dealt with my queries promptly. I rarely leave reviews but this company have restored my faith in umbrella.

Why choose Cool Company as your payroll solution?

- Easy timesheet recording, with everything in one place

- Same day payments on all payments to you

- Friendly personal support through phone, chat, and email

PAYE done right

- All taxes and national insurance deductions made and reported to HMRC. Ensuring you’re compliant and free from risk – no self-assessment tax returns

- Comprehensive insurance cover including Public Liability, Professional Indemnity and Employers Liability

- Access to all employment rights including SSP, SMP/SPP and holiday pay

- No more IR35 worries – when using our payroll services, you are outside the scope

Join us today!

Join the 100,000 + contractors who have used our service. No obligation or subscription costs. All taxes paid for you. Easy, simple, peace of mind.