What is Umbrella Pay Rate?

Umbrella pay refers to a method of paying temporary workers who work through an employment agency or umbrella company. Instead of being paid directly by the company they work for, the worker is employed by the umbrella company who then processes their pay and deducts any necessary taxes and National Insurance contributions before paying the worker. This method of payment is often used by contractors, freelancers, and other temporary workers who work on short-term assignments or projects. The umbrella company takes care of administrative tasks such as invoicing and accounting, leaving the worker free to focus on their work.

What you need to know before quoting your client

Whether this is your first time working through an umbrella company or you’re a seasoned pro, it never hurts to understand what an umbrella rate of pay is. There is currently and always has been a good amount of confusion surrounding the amount the umbrella company invoices your client and how much you receive as your payment. This blog aims to remove the confusion.

Let’s start with “What’s the difference between pay rate and umbrella rate?” Well, your pay rate is the amount you expect to be paid for the work you perform, the umbrella rate is the amount the umbrella will invoice your client for the work you perform. Now, you may think that these 2 things are exactly the same but they’re not.

Umbrella Companies and National Insurances

Every employee in the UK is subject to National Insurance contributions, these are made up of an employer’s contribution and an employee contribution. Umbrella companies are no different as an employer they need to ensure these contributions are made with easy payment. And to ensure this happens, the contribution to employer’s National insurance has to be taken from the invoice paid by your client. This means that the rate you quote your client needs to be uplifted to cover the employer National Insurance contributions otherwise your actual take-home pay may be less than expected.

Additionally, as an umbrella contractor you are entitled to holiday pay, this is to ensure that you are able to take a holiday without being financially impacted. Holiday pay comes in 2 forms: rolled up or accrued (that’s a whole article in itself). However, to account for this your expected pay rate will need to be uplifted to account for this also.

While this employer cost is common knowledge not all clients factor this in when hiring contractors and not all contractors factor this in the rate they negotiate with their clients. When providing services to your client via an umbrella company you need to ensure that the agreed charge rate is enough to cover employment cost and your expected earnings.

How to calculate your umbrella rate

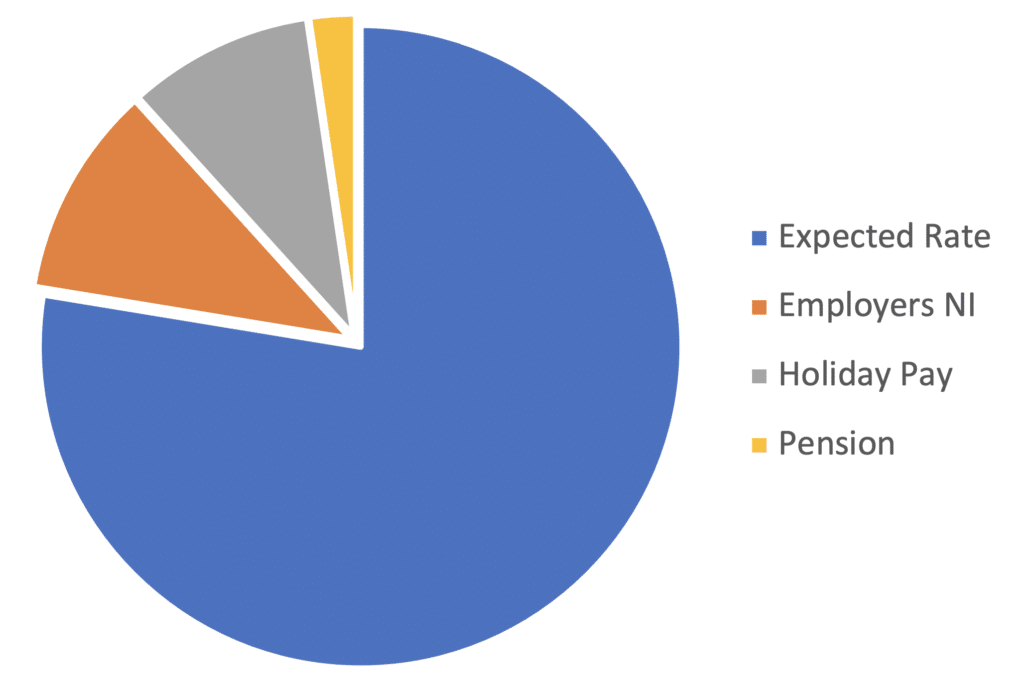

Luckily the calculation is fairly simple and makes uplifting your rate much easier than you would expect. As a contractor operating via and an umbrella, you need to ensure the rate you negotiate has been uplifted by 13.8% for Employers NI and 12.07% for Holiday pay allowance at a minimum. Auto-Enrollment pension contributions from the employer are set at 3% but not everyone opts for the pension so this uplift is a personal choice.

Using the figures above please see an example below of how to correctly calculate your umbrella rate for presentation to a client:

- Your Expected hourly rate is £25.00

- Employers NIC is £3.45 per hour

- Holiday Pay allowance £3.02 per hour

- (Optional) Pension £0.75 per hour

This means your quote to the client is £31.47 per hour or £32.22 (with pension contributions)

By securing these rates with your client you will ensure that the payment received less deductions is in line with your expectation of £25 per hour. As you can see it’s not a complicated process but it is an important one to ensure you receive the funds you expect.