Get ready for the rebound

Positive Economic Drivers for the UK: Q4 2020 to Q2 2021

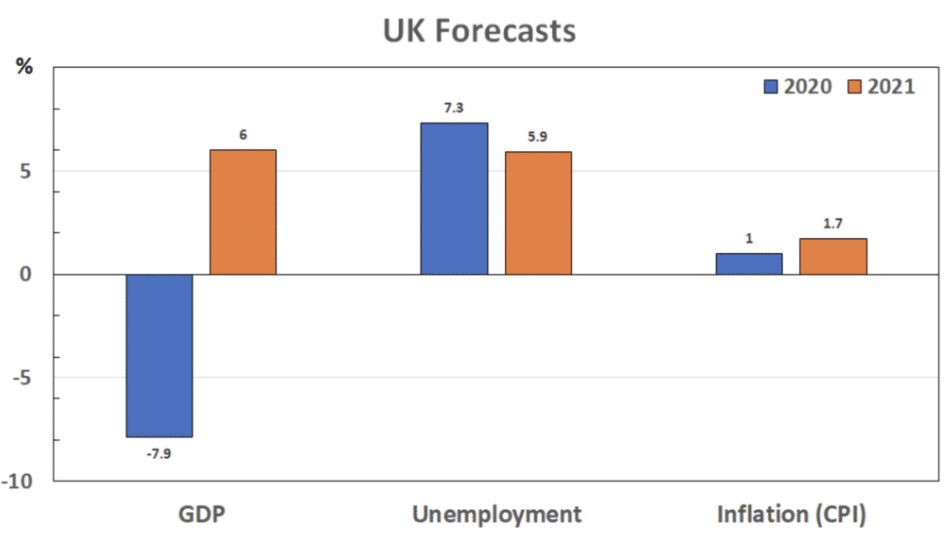

“Inflation is expected to remain below the Bank of England’s 2% target

rate through to 2021.”

After a sharp and painful recession, the UK’s economy is expected to recover in the second half of 2020 with a 6% rebound in 2021. The key drivers for the rebound will be a recovery in consumer spending, business investment, and an increase in exports.

In August, the release of the June GDP figures will likely confirm that the UK is in recession. It may be the worst for a long time. But unlike a normal recession, recovery is expected to be much quicker.

In May, Her Majesty’s Treasury compared the GDP forecasts of 39 banks and organisations. It found that the average forecast for Q2 growth was -15.6% (in annual terms). But Q3 is expected to recover to 11.1%. 2020 is expected to be -7.9% overall but growth will rebound to 6% in 2021 (see chart below). The Bank of England has 2021 GDP as high as 15%.

The release of pent up consumer demand will lead to increased growth in the second half of 2020 and the first half of 2021. Consumer spending is the largest source of expenditure in the economy: 63% in 2019.

The release of pent up consumer demand will lead to increased growth in the second half of 2020 and the first half of 2021. Consumer spending is the largest source of expenditure in the economy: 63% in 2019.

Unlike a normal recession, 8 million of those currently not working are still receiving 80% of their income through the government’s job retention scheme. They also remain employed. This means that as the economy begins to open, these consumers will be armed and ready to spend.

Continued low inflation will also increase the purchasing power of consumers. Inflation is expected to remain below the Bank of England’s 2% target rate through to 2021.

Business investment is also expected to drive the rebound in growth. While some sectors have been hit hard, others, such as financial services, have weathered the downturn.

Some businesses have also built up cash through the deferment of Q2 VAT payments, government assistance, and tax holidays. So as the economy opens, these businesses are expected to increase investment.

It is also expected that the Bank of England will continue to support the recoverythrough low interest rates and its program of quantitative easing.

Exports will also contribute to the rebound with the recent depreciation of Pound sterling, and the expected recovery in world GDP. The Chinese economy is already showing signs of recovery.

The expected conclusion of the Brexit deal with the EU should also give a boost to the economy and exports. Talks are likely to start moving again once the EU presidency moves to Germany in September. A deal may happen as soon as the meeting of EU leaders in October.

Of course, the speed of the recovery will depend on how quickly lockdown restrictions are lifted and whether they will be reimposed at any point. It also depends on how quickly consumer and business confidence returns.

By Brendan Filipovski

Do you want to know more?

Do you have any questions or are you ready to get started with Cool Company?