Umbrella Company Margin, but what does it mean?

For many years those new to the umbrella company payroll solution have struggled to understand the way it works and the structure of the Margin taken by the umbrella company on the payslip. Well, today, I will give you a peek behind the curtain and explain the pricing in simple terms. Oh, and I will also cover the benefits too!

“Now the industry operates a volume-based business model, which helps keep the Margin amount small.”

Let’s start with the most confusing word and the one least explained online Margin!

What is Umbrella Company Margin?

An Umbrella Company Margin refers to the amount the Umbrella Company retains to cover the cost of administration. This margin is retained for the invoice your client pays.

It’s an administration cost and it covers the cost of running the payroll and the cost of insuring your work with the client your supplying services too, plus all the other operational costs associated with running a business. Now the industry operates a volume-based business model, which helps keep the Margin amount small. Therefore, a successful umbrella company needs many customers to remain profitable.

Universally the Margin is taken before tax, meaning that in purely mathematical terms you don’t actually pay the full amount advertised. It will cost you anywhere between 20% or 40% less depending on your tax rate.

What margin does Cool Company charge?

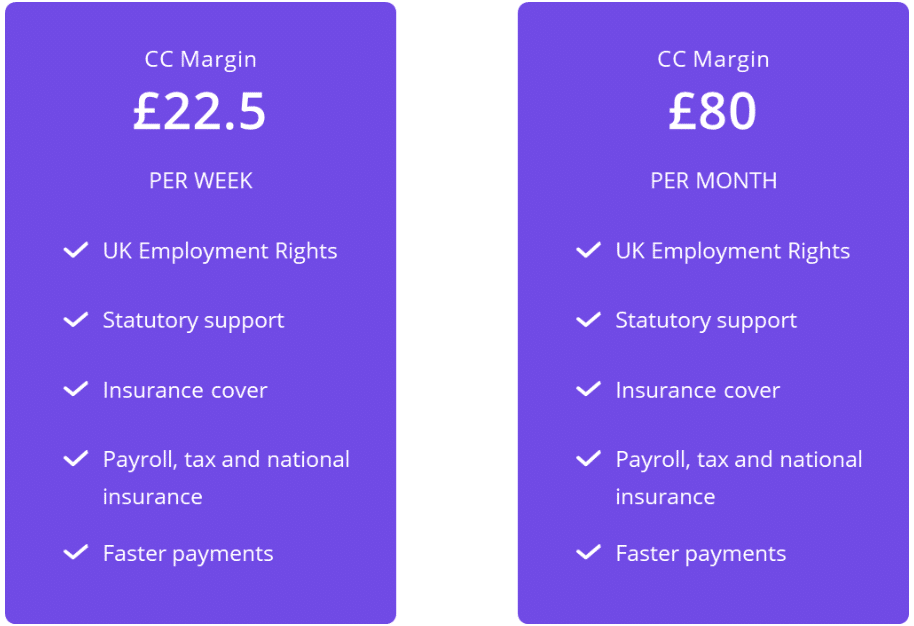

Cool Company has two options when it comes to Margin. These are based on the frequency of the payment you receive. If the payment is weekly we will deduct £22.50, if it’s a monthly schedule, then it’s a flat £80 per payment.

Does Cool Company charge any hidden costs?

While margin should be umbrella companies’ main source of income, some Umbrella companies have additional costs that could have an impact on your take-home pay. We do not charge any hidden costs, such as, sign upp fees, exit fees, surcharges for insurance or processing expenses.

For this, you receive all these benefits!

- The security that you are covered by all UK Employment Rights

- Access to statutory support such as Sick Pay, Maternity and Paternity Pay

- Insurance cover for the work you are providing to your client

- Complete management of your payroll, tax and National Insurance deductions made

- Quick payment with all payments made via the Faster Payment process

And there you have it, I hope this clears up the confusion and mystic about the umbrella company pricing!

Have a great day and any questions contact me via the chat function!

Kris Simpson

Do you want to know more?

Do you have any questions or are you ready to get started with Cool Company?