Net Salary

Let’s start from the beginning, what does net salary mean? Simply put, net salary is the amount you receive in your account after taxes and fees have been deducted. Below, we explain more!

What is net salary?

Cool Company clarifies what the term net salary means once and for all. In short, your net salary is the amount you receive in your account after taxes and fees have been deducted. Let us help you calculate your salary after tax.

How do you calculate your net salary?

Yes, how do you calculate your net salary based on your gross salary? We help you calculate your net salary after tax. Because it is precisely the matter of tax and social fees that differentiates the invoiced value from your net income or net salary, i.e., the salary you receive in your account.

As an aid to help you more easily calculate net salary for the value you invoice, we offer an invoice calculator. Use it to determine what our fee is, what taxes and social fees are, and finally, what net salary is.

A small glossary

Self-employed

Self-employment means that you can be freelance or a consultant and invoice without a company by having the F-tax certificate through us at Cool Company.

F-tax

F-tax, or corporate tax, is a tax that all companies are required to pay. Companies must have a so-called F-tax certificate, but as self-employed with Cool Company, we pay F-tax for you. That way, you can invoice as a private individual since you use our F-tax.

Net salary

Net salary is the amount you receive as salary and is deposited into your account after taxes and fees have been deducted.

Employer’s contributions

Employer’s contribution is a part of the social fees that employers pay to the tax agency for each employee.

Three common questions about net salary

Who determines my net salary?

Your net salary when you are self-employed is based on how much you invoice and what remains after taxes, social fees, and our fee have been deducted.

Why do you need to keep track of net salary?

To plan your finances, it is primarily incomes and expenses that you need to keep the best track of. Net salary usually constitutes the main income.

How do you calculate your net salary?

To calculate your net salary as self-employed, you need to deduct taxes, social fees, and our fee. To make it a little easier for you to calculate your net salary, we have created an invoice calculator that does the job for you.

From invoice to net salary

Through us at Cool Company, many self-employed people invoice, thus avoiding handling administration such as paying taxes and social fees. We take care of that and ensure that each self-employed person receives their net salary paid out. Professions and industries among self-employed people vary almost as much as the number of people in the industry. Some work as freelance copywriters, others are IT consultants, some are in the construction industry, and some are in health. Then, of course, we have all imaginable professions in between as well. As long as you sell a competence and a service that is approved by us, we can help you with invoicing and administration. Easy as pie. It goes something like this:

First and foremost, you create an account with us. When you are offered an assignment and have agreed on a reasonable fee with your customer, we recommend that you ensure there is a written agreement. If an unwanted situation arises, it is always comforting to know that you have more than a handshake in the background.

Before you start working, it is important that you pre-notify the assignment you want to undertake before you start working on it. It is important for you to be insured when you are on assignment, if an accident were to happen.

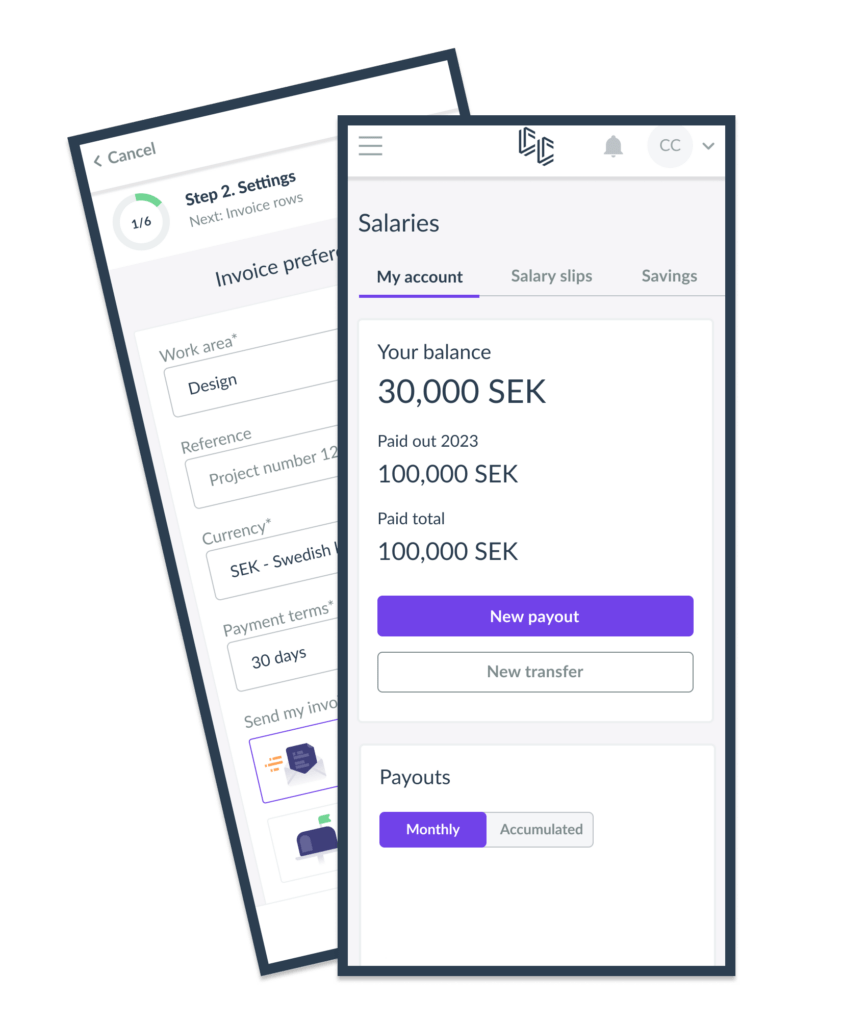

In the next step, you can be insured and securely start performing your assignment. Some consultants take on assignments over many months, some perform multiple assignments in a day. Regardless of how your work structure looks, we help you with your invoicing when the time comes. You log in with a push of a button and fill in the correct information when you create the invoice, then it’s done. We at Cool Company ensure that all administration is handled.

Finally, the finished invoice is sent to your customer, and after they have paid the invoice, we can pay out your salary taxed and clear – that’s your net salary.

Time to take the next step?

Get ready to start within minutes and register for free. Our customer support is only a chat, call or email away if you need them.