Gross Salary

Now, let’s get to the bottom of the concept of gross salary, starting from the beginning with the most common question – what does gross salary mean? To explain the concept as simply as possible, one can say that gross salary is the salary one receives before taxes and fees are deducted.

What is Gross Salary?

Gross salary is the salary usually seen in one’s pay slip. It shows the amount before taxes and social security contributions have been deducted. Gross salary also includes any allowances and deductions.

To explain what gross salary is to someone who is permanently employed, you can describe it approximately like this: gross salary is the salary you receive before tax deductions. Then, the taxed salary, that is, your net salary, lands in your account. It is your employer who ensures that tax and social security contributions are deducted from your gross salary and that the remaining amount is then paid out to you.

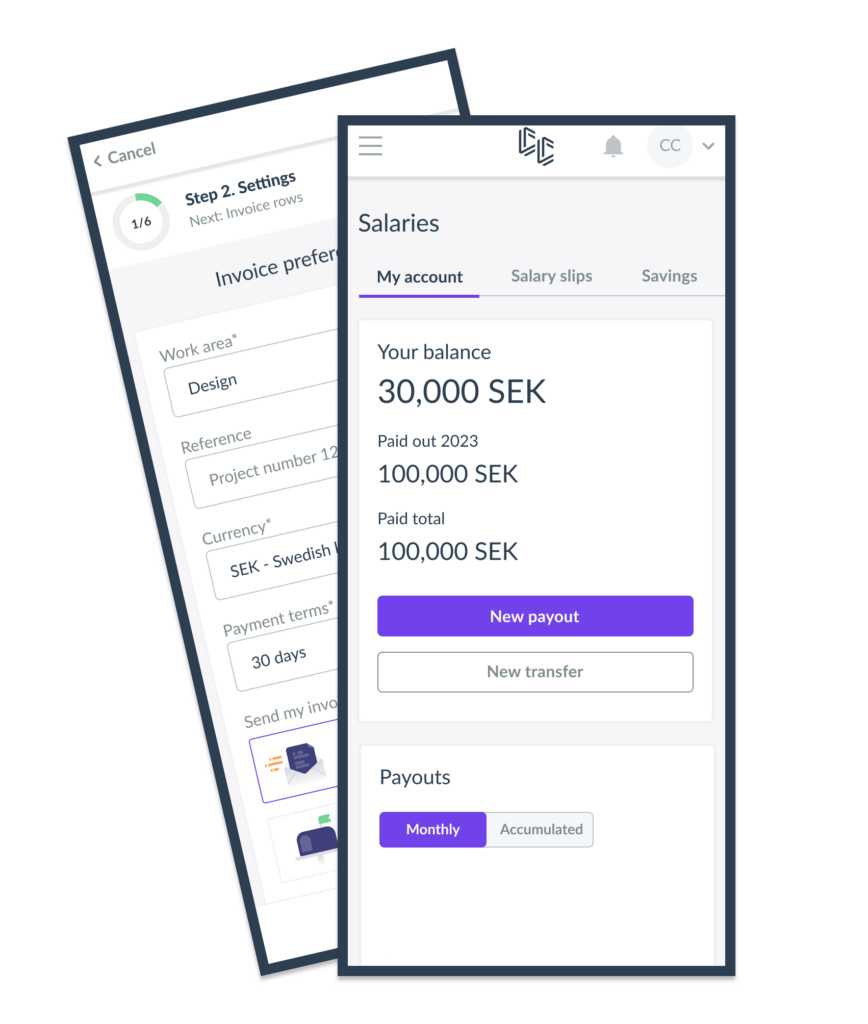

If you run, for example, a sole proprietorship, you have to manage to pay the correct tax and fees yourself. But if you are self-employed through us at Cool Company, we ensure that taxes and social security contributions are deducted from your gross salary before we pay out your taxed salary to you. So, it’s good to remember when pricing your services that the amount you specify on the invoice is not what ultimately ends up in your wallet.

How to Calculate Gross Salary?

As we mentioned earlier, it is tax and social security contributions that need to be paid and deducted from the gross salary before you receive your salary. If you are self-employed, you also pay a fee to the self-employment company to handle all administration and ensure that the correct tax and fees are paid to the Tax Agency.

Social security contributions in Sweden account for 32.41 percent of the invoice value; you also pay a fee of 5.98 percent of the invoice value to Cool Company for us to handle the administration. Then, you have to pay tax, which is about 30 percent, on the amount left after the contributions have been deducted. What remains is your salary and what comes into your account.

Social security contributions are a major tax, the largest we have in Sweden, and despite that, surprisingly many are unaware of it and instead expect to receive the gross salary deposited into their account.

Instead of having to deal with the calculator and tear your hair out, we have developed a calculator that allows you to easily see how much of your gross salary ends up in your wallet after tax and contributions have been paid. We also of course report the amounts that need to be paid as contributions.

Avoid Dealing with Gross Salary

One of the many reasons why freelancers choose to be self-employed instead of starting their own limited company or sole proprietorship is precisely to avoid dealing with things like administrating tax and contributions to the Tax Agency. We at Cool Company handle all such matters for you; you don’t have to think about it and can instead focus fully on your assignment.

The stress surrounding administration and money management, in general, is what makes many recoils from becoming self-employed. Even though one has a really good business idea and is ready to take the step towards a more free and flexible working life. The golden path is precisely self-employment – the freedom like an entrepreneur, but the security like an employment.

In addition to avoiding handling all administration, people are drawn to freelancing as self-employed because of the freedom it offers. They want to control their own working hours, and to a large extent, also their own income. The more assignments, the higher the gross salary, and ultimately more money in the pocket.

Time to take the next step?

Get ready to start within minutes and register for free. Our customer support is only a chat, call or email away if you need them.