Salary Calculator Sweden for freelancers

Working as a freelancer and getting a salary as if you were employed – how it work and what you need to know. We provide guidance, customer support and right here a Swedish salary calculator.

What do I earn and what do I take home after taxes?

There are many questions one can ask. How much and what should I invoice? How much should I invoice for a certain salary? And what do I earn as a salary from what I invoice? In the invoice calculator, you can check how much you earn as a salary from what you invoice! You can also see how much goes towards employer contributions, taxes, and social contributions.

You do the work and decide how much it should cost – and you take home roughly half of that amount. What happens to the money along the way? For you, as a new freelancing self-employed individual, the question of “What salary do I want?” is important to consider. The amount you want as a salary is what you need to base your calculation on when determining the price for your services to customers. What you invoice is not what you take home; you need to check what you take home and convert the invoice to a salary.

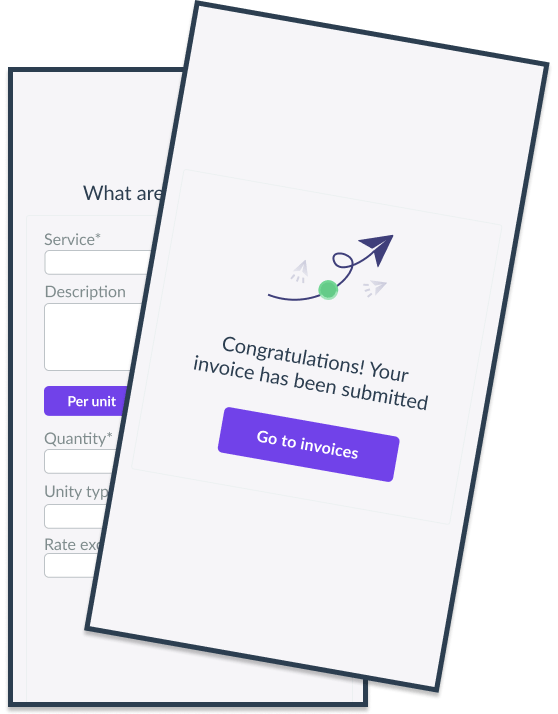

Cool Company handles and sends out the invoices to customers that the self-employed individuals send to us. We also monitor and handle reminders if needed. As soon as the customer has paid the invoice and the money has come in, we pay out the salary.

In connection with that, we deduct our fee of 5.98%, as well as employer contributions and taxes. The net salary, i.e., what comes into your account, usually ends up being approximately half of the invoiced amount.

Even if you are a self-employed individual with corporate tax, you cannot keep more money as a salary. The difference is that as a self-employed individual, you must manage bookkeeping and tax payments yourself, while Cool Companys service handles the work for you when you are self-employed.

Calculate your salary after taxes and fees in Sweden

Use our Swedish salary calculator to figure out how much of the invoiced amount you will have in your wallet after taxes and fees have been deducted. Cool Company assists you in managing the payment of taxes, VAT, and more.

Salary on your account

4 803 SEK

Pension

308 SEK

Total compensation

5 254 SEK

Your net salary

4 803 SEK

Pension

308 SEK

Taxes & social fees

4 289 SEK

Cool Company fee 5,98%

598 SEK

How is salary calculated in Sweden?

In Sweden, salary calculation is based on several components, including the gross salary, social security contributions, and income tax. The gross salary is the total amount before any deductions. From this, employers deduct income tax, which is progressive and varies depending on the income level and the municipality. Additionally, social security contributions are made by the employer to cover benefits like healthcare, pensions, and unemployment insurance. The net salary, or take-home pay, is what remains after these deductions. Salary calculations may also include allowances, bonuses, and overtime pay, depending on the employment contract.

What is the minimum wage in Sweden?

Sweden does not have a statutory minimum wage set by the government. Instead, wages are determined through collective bargaining agreements between unions and employers. These agreements vary by industry and job role, so minimum wage levels can differ depending on where and what you work. Typically, wages are negotiated annually and are influenced by factors such as experience, location, and industry standards. While there is no official minimum wage, most agreements ensure that workers receive fair compensation that aligns with the cost of living in Sweden.

How much tax do you pay in Sweden?

The amount of tax you pay in Sweden depends on your income level and the municipality you live in. Sweden has a progressive tax system, meaning that higher income levels are taxed at higher rates. The income tax is divided into municipal tax, which ranges from about 29% to 35%, and state tax, which applies to higher incomes at a rate of 20% or 25%. Additionally, there are deductions and allowances that can reduce your taxable income. In total, the average tax rate for most people ranges between 30% and 55% of their income.

How much of my invoice amount do I take home?

If you are a freelancer or run your own business in Sweden, the amount you take home from an invoice depends on several factors, including taxes, VAT, and business expenses. After issuing an invoice, you must account for VAT (usually 25%) and income tax, which can range from 30% to 55% depending on your total earnings. You’ll also need to cover social security contributions, which are roughly 28.97% of your income. After deducting these expenses, the remaining amount is your take-home pay. Managing deductions and accounting for expenses accurately is essential to understanding your net income.

What affects my salary?

For a regular employee, there are some other factors that can influence how much money ultimately lands in their account. Examples of such factors can include travel reimbursements, wellness benefits, subsistence allowances, and expenses incurred by the employee for the company. As a self-employed individual, it’s important to include all of this when invoicing.

In Sweden, we have a progressive income tax system. This means that you pay different amounts of tax depending on how much you earn. Cool Company typically withholds 30% of your gross salary, but in some cases, it might be wise to withhold more or less. We do this if you change your tax withholding. As a self-employed individual invoicing without a company, there are additional taxes and fees that impact your salary.

Most important factors affecting your salary:

Our Fee

A portion of the amount on your invoice that doesn’t appear in your salary is the fee we charge to handle all administration for you. This means you don’t have to spend time and energy on taxes, VAT, and fees. Our fee is 5.98% of the invoice value.

Employer Contributions

Another portion of the amount is allocated to employer contributions. This must be paid for everyone working and receiving a salary in Sweden and amounts to 31.42 percent. For those born between 1956 and 1938, employer contributions are lower, at 10.21 percent.

Occupational Pension

If you are between 25 and 67 years old and self-employed, a sum for occupational pension is also deducted. Since January 1, 2023, we are affiliated with the Sales Collective Agreement, and 4.5 percent of your earned fee is automatically allocated to occupational pension from your invoice.

Income Tax

Last but not least, you need to pay income tax on your earnings. It is paid to the city and municipality where you are resident. Generally, it is around 30 percent.

A small glossary

Self-employed

Self-employment means that you can work as a freelancer or consultant and invoice without having a company by having the F-tax certificate through us at Cool Company.

Corporate tax

Corporate tax, is a tax that all businesses are required to pay. Businesses must have a so-called corporate tax certificate, but as a self-employed individual with Cool Company, we handle the corporate tax payment for you. This allows you to invoice as an individual since you use our F-tax certificate.

Net Salary

Net salary is the amount you receive as a salary, deposited into your account after taxes and fees have been deducted.

Employer Contributions

Employer contributions are a part of the social fees that employers pay to the tax agency for each employee.

Get started

Join the 80,000 + freelancers using our service. With no obligation or subscription fees, you have nothing to lose. All taxes paid for you. Easy, simple, peace of mind.