Our service

Here, we delve a bit deeper into our service, which you, as someone planning to freelance, can use to avoid starting a company.

Invoicing as an individual to businesses

Invoicing may seem complicated, but it doesn’t have to be – especially if you, as an individual, use Cool Company. When you create a free account with us, you have the flexibility to choose whether you freelance without a company full-time, part-time, or on the side. Similarly, you decide whether you invoice frequently or infrequently.

We often describe our service as offering users the same freedom as a freelancing entrepreneur, with the security and support of an employee. You have the autonomy to choose your clients and assignments, while receiving assistance with all administrative tasks and the payment of taxes and fees. Additionally, you are insured and secure during your assignment period.

Should you have any questions or concerns, our customer support is available via phone, email, and chat right here on the website.

We also recommend you to use our salary calculator to get a good overview of your take home salary after tax and fees.

About VAT and Invoicing through us

VAT, or value-added tax as it is officially called, is a tax applied to virtually all goods and services. When you purchase something as an individual, VAT is generally included in the price you pay, and therefore, it’s something you don’t need to worry about.

Businesses, on the other hand, can both sell and purchase goods and services subject to VAT, which means that VAT is handled a bit differently.

Here are the key points you, as a self-employed individual, need to consider regarding VAT:

Almost all services and goods are subject to VAT in Sweden.

The VAT rate varies depending on the type of goods and products, but for services, it is usually a 25% VAT rate.

VAT is a part of the invoice value that you cannot count as your own money.

You can never consider VAT as your own money – it is always paid to the state as a tax

As a self-employed individual, you invoice with Cool Company’s VAT details.

Cool Company is responsible for paying the correct amount of VAT to the Swedish Tax Agency for its entire operation, including that from all self-employed individuals’ invoices

RUT and ROT Deductions on the Invoice

When it comes to deductions, there are probably no celebrities in this category that anyone has missed. We’re, of course, referring to RUT and ROT deductions. One likely reason for their fame is that these deductions are beneficial for individuals. That’s why it can be helpful for businesses and individuals invoicing to keep an extra eye on these deductions.

ROT, which stands for repair, conversion, and extension, is likely applicable for those working in construction. It simply means that 30% of the labor cost is deductible, up to a maximum amount of 50,000 SEK.

RUT, which stands for cleaning, maintenance, and laundry, is used for household services. It means that 50% of the labor cost can be deducted. There is also a maximum amount for RUT deductions: 25,000 SEK per year for individuals under 65 and 50,000 SEK for those over 65.

The advantage of using RUT and ROT deductions when invoicing is that your customer can get a portion of the invoiced amount reimbursed by the Swedish Tax Agency. This makes the cost for the customer lower, and it becomes easier for you to secure assignments.

RUT and ROT with Cool Company

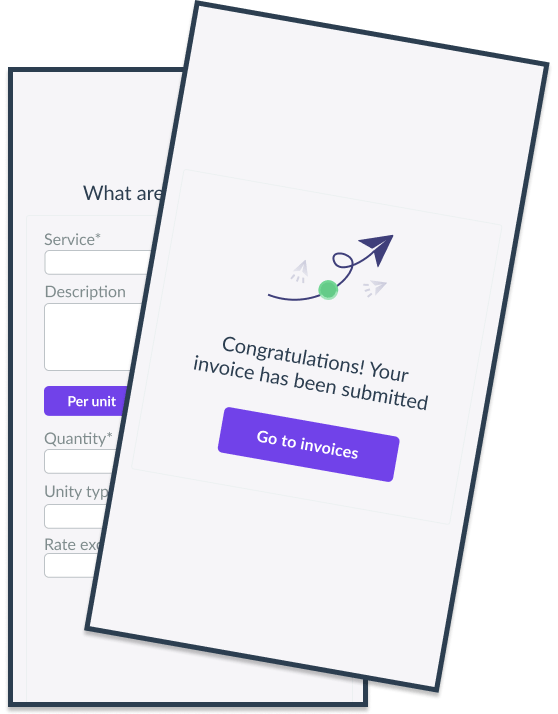

In our service, it’s easy to handle both ROT and RUT. When filling in the invoice details, select the ROT/RUT option.

Don’t forget the personal identification number

For RUT & ROT deductions, fill in your customer’s personal identification number. Information about the property

Information about the property

For ROT deductions, provide the property designation, and for condominiums, the housing association’s organization number and apartment number. The rest is handled automatically.

Get started

Join the 80,000 + freelancers using our service. With no obligation or subscription fees, you have nothing to lose. All taxes paid for you. Easy, simple, peace of mind.